Watching the Watchers

On the Expert Networks Translating Central Bank Communication

Supervisors

- Antoine Vauchez

- Amandine Crespy

Research abstract

The ECB has increasingly stretched its mandate in the face of conflicting pressures arising from its responsibility to maintain both price and financial stability. Alongside the lack of a full-blown fiscal counterpart at the EU level that can provide macroeconomic stabilisation, this context has encouraged monetary policy innovation. The latter, particularly when impacting sovereign debt markets, brings about recurrent political struggles and increasingly complicates the ECB’s independence. In response to growing dissensus and in line with the exhaustion of other monetary policy instruments in a zero lower bound environment, the ECB has significantly expanded its communication in the form of forward guidance and beyond, in particular with the ‘general’ public.

Given the importance of inflation expectations in monetary policy, its success fundamentally depends on a central bank’s communicative efforts to legitimise policy action and shore up trust in its political and economic credibility. Instead of listening to the central bank, most market participants as well as the general public, however, listen to a group of translators, the so-called ECB Watchers, who spell out the implications of the ECB’s policy measures to its diverse audiences. While there is a substantial amount of research on central bank communication (cf Blinder et al,2001/2008/2022), the literature’s focus on ECB-owned output fails to adequately reflect the fact that close to 60% of its Eurozone audience learns about the ECB and its policies through indirect sources only (Assenmacher et al, 2021:55). Initial research on the interaction between the ECB and the media (e.g. Ferrara & Angino, 2022; Koop & Scotto di Vettimo, 2023) focuses on broad measures of quantitative text analysis such as the extent of coverage and sentiment analysis, but does not speak to actors’ backgrounds, networks or their sensemaking function about which we know little (Ibrocevic PhD Thesis 2024; Mudge & Vauchez, 2012/2016; Schmidt-Wellenburg, 2017). It therefore remains unclear how and to what end these translators engage with the ECB’s discourse, and vice versa.

This is an important oversight as the so-called “ECB Watchers” constitute a knowledge community that can credibly contest or support the ECB’s epistemic authority in and beyond financial markets. In doing so, they equally affect the efficacy of its monetary policy by furthering market understanding and influencing expectation formation and therefore the transmission of monetary policy and the ECB’s legitimacy vis-à-vis a broader public, holding the ECB accountable. This function is particularly crucial in a eurozone marked by crises that have seen the ECB pick up the political slack and integrating through the monetary backdoor (Schelkle, 2012). Researching these actors can then facilitate an improved understanding of the ECB’s interaction with its publics, moving beyond a top-down approach that is focused on ECB output. It can elucidate how the need for a unified monetary policy discourse on the one and diverse (national) audiences, on the other hand, is negotiated in practice.

Empirically, the project, therefore, proposes to study the so-called ECB Watchers, a diverse group of financial market and media actors as well as academics, in their role as translators between the ECB and its audiences as they “play an important role in interpreting central bank actions, disseminating and deciphering for the broad public the information released by central banks” and in “provid[ing] alternative opinions, lessening the monopolistic power of central banks” (Blinder et al, 2001:26). Following an initial investigation of the ECB’s approach to these translators via interviews and document analysis, the project characterises them by way of interviews and a social network analysis on a number of conferences they participate in. The project thus provides a novel dataset and highlights actors’ practices as well as the interconnectedness of this communicative sphere in which insider-outsider distinctions blur. In a final step, the project mobilises Leifeld’s (2012) discourse network analyser to investigate epistemic contestation over macroeconomic policy in the post-COVID inflationary period focusing on the period between late 2021 and July 2022 when the ECB first hiked rates since 2011. These dynamics will be observed in specialised newspapers at the European level and in the two countries most polarised on monetary policy, Germany and Italy.

Overall the project speaks to a broader research agenda on the sensemaking processes that link international institutions and international organisations to national public spheres, influencing their reputation and effectiveness. Understanding these processes is particularly crucial in our current age of technocratic ruling by emergency that is legitimised in the discursive construction of crises.

Given the importance of inflation expectations in monetary policy, its success fundamentally depends on a central bank’s communicative efforts to legitimise policy action and shore up trust in its political and economic credibility. Instead of listening to the central bank, most market participants as well as the general public, however, listen to a group of translators, the so-called ECB Watchers, who spell out the implications of the ECB’s policy measures to its diverse audiences. While there is a substantial amount of research on central bank communication (cf Blinder et al,2001/2008/2022), the literature’s focus on ECB-owned output fails to adequately reflect the fact that close to 60% of its Eurozone audience learns about the ECB and its policies through indirect sources only (Assenmacher et al, 2021:55). Initial research on the interaction between the ECB and the media (e.g. Ferrara & Angino, 2022; Koop & Scotto di Vettimo, 2023) focuses on broad measures of quantitative text analysis such as the extent of coverage and sentiment analysis, but does not speak to actors’ backgrounds, networks or their sensemaking function about which we know little (Ibrocevic PhD Thesis 2024; Mudge & Vauchez, 2012/2016; Schmidt-Wellenburg, 2017). It therefore remains unclear how and to what end these translators engage with the ECB’s discourse, and vice versa.

This is an important oversight as the so-called “ECB Watchers” constitute a knowledge community that can credibly contest or support the ECB’s epistemic authority in and beyond financial markets. In doing so, they equally affect the efficacy of its monetary policy by furthering market understanding and influencing expectation formation and therefore the transmission of monetary policy and the ECB’s legitimacy vis-à-vis a broader public, holding the ECB accountable. This function is particularly crucial in a eurozone marked by crises that have seen the ECB pick up the political slack and integrating through the monetary backdoor (Schelkle, 2012). Researching these actors can then facilitate an improved understanding of the ECB’s interaction with its publics, moving beyond a top-down approach that is focused on ECB output. It can elucidate how the need for a unified monetary policy discourse on the one and diverse (national) audiences, on the other hand, is negotiated in practice.

Empirically, the project, therefore, proposes to study the so-called ECB Watchers, a diverse group of financial market and media actors as well as academics, in their role as translators between the ECB and its audiences as they “play an important role in interpreting central bank actions, disseminating and deciphering for the broad public the information released by central banks” and in “provid[ing] alternative opinions, lessening the monopolistic power of central banks” (Blinder et al, 2001:26). Following an initial investigation of the ECB’s approach to these translators via interviews and document analysis, the project characterises them by way of interviews and a social network analysis on a number of conferences they participate in. The project thus provides a novel dataset and highlights actors’ practices as well as the interconnectedness of this communicative sphere in which insider-outsider distinctions blur. In a final step, the project mobilises Leifeld’s (2012) discourse network analyser to investigate epistemic contestation over macroeconomic policy in the post-COVID inflationary period focusing on the period between late 2021 and July 2022 when the ECB first hiked rates since 2011. These dynamics will be observed in specialised newspapers at the European level and in the two countries most polarised on monetary policy, Germany and Italy.

Overall the project speaks to a broader research agenda on the sensemaking processes that link international institutions and international organisations to national public spheres, influencing their reputation and effectiveness. Understanding these processes is particularly crucial in our current age of technocratic ruling by emergency that is legitimised in the discursive construction of crises.

Personal Research Bibliography (So Far)

Beckert, J., 2013. Imagined futures: fictional expectations in the economy. Theory and Society, 42 (3), pp.219-240.

Beckert, J. 2013. Capitalism as a System of Expectations: Toward a Sociological Microfoundationof Political Economy, Politics & Society, 41(3), pp. 323–350.

Berger, P. & Luckmann, T., 1968. The Social Construction of Reality: A Short Treatise on the Sociology of Knowledge. In F. Dobbin, ed. The New Economic Sociology: A Reader. Princeton, NJ: Princeton University Press, pp.296 317.

Best, J. 2012. Bureaucratic ambiguity, Economy and Society, 41(1), pp. 84–106.

Best, J. 2022. Uncomfortable knowledge in central banking: Economic expertise confronts the visibility dilemma, Economy and Society, pp.1 25.

Blinder, A., Ehrmann, M., Fratzscher, M., De Haan, J. & Jansen, D.-J. 2008. Central Bank Communication and Monetary Policy: A Survey of Theory and Evidence, Journal of Economic Literature , 46 (4), pp.910 945.

Braun, B., 2015. Governing the future: The European Central Bank’s expectation management during the Great Moderation. Economy and Society 44 (3), pp.367 391.

Bressanelli, E., Koop, C. and Reh, C. 2020. EU Actors under Pressure: Politicisation and Depoliticisation as Strategic Responses, Journal of European Public Policy, 27, 329–341.

Callon, M. 2007. What does it mean to say that economics is performative? In D. MacKenzie, F. Muniesa & L. Siu (Eds.), Do economists make markets? On the performativity of economics (pp. 311 357). Princeton University Press.

Coombs, N. 2022. Narrating imagined crises: How central bank storytelling exerts infrastructural power, Economy and Society, pp. 1 24.

Diessner, S. 2022. The power of folk ideas in economic policy and the central bank commercial bank analogy, New Political Economy, pp. 1 14.

De Wilde, P. 2019. Media logic and grand theories of European integration, Journal of European Public Policy, 26(8), pp. 1193 1212.

Do Vale, A., 2021. Central bank independence, a not-so-new idea in the history of economic thought: a doctrine in the 1920s. The European Journal of the History of Economic Thought, 28(5),pp.811-843.

Elgie, R. 2002. The politics of the European Central Bank: principal-agent theory and the democratic deficit, Journal of European Public Policy, 9 (2), 186-200.

Entman, R. M. 1993. Framing: Toward Clarification of a Fractured Paradigm. Journal of Communication, 43(4), pp.51 58.

Eyal, G., 2013. For a sociology of expertise: The social origins of the autism epidemic. american Journal of Sociology, 118(4), pp.863-907.

Eyal, G., 2013. Spaces between fields. Bourdieu and historical analysis, pp.158-182.

Ferrara, F.M. and Angino, S., 2022. Does clarity make central banks more engaging? Lessons from ECB communications. European Journal of Political Economy, 74.

Fourcade, M., 2006. The construction of a global profession: The transnationalization of economics. American Journal of Sociology 112 (1), pp.145 194.

Holmes, D.R., 2013. Economy of words: Communicative imperatives in central banks. University of Chicago Press.

Jasanoff,S. ed., 2004. States of knowledge: the co-production of science and the social order. Routledge.

Kauppi, N. and Madsen, M.R. 2014. Fields of Global Governance: How Transnational Power ElitesCan Make Global Governance Intelligible, International Political Sociology, 8(3), pp. 324–330.

Koop, C. and Scotto di Vettimo, M. 2022. How do the media scrutinise central banking? Evidence from the Bank of England, European Journal of Political Economy, p. 102296.

Lebaron, F. 2008. Central Bankers in the Contemporary Global Field of Power: A Social Space Approach, The Sociological Review, 56(1_suppl), pp. 121–144.

Lohmann, S. 2003. Why do institutions matter? An audience-cost theory of institutional commitment, Governance, 16 (1), 95-110.

Marcussen, M. 2009. Scientization of central banking: The politics of A politicization. In K. Dyson & M. Marcussen (Eds.), Central banks in the age of the euro (pp. 373 401). Oxford University Press.

McCloskey, D.N., 1990. If you're so smart: The narrative of economic expertise. University of Chicago Press.

Medvetz, T., 2012. Murky power:“Think tanks” as boundary organizations. In Rethinking power in organizations, institutions, and markets (Vol. 34, pp. 113-133). Emerald Group Publishing Limited.

Morris, S. and Shin, H.S. 2002. Social Value of Public Information, The American Economic Review,92(5), pp. 1521–1534.

Moschella, M., Pinto, L. & Diodati, N. 2020. Let's speak more? How the ECB responds to public contestation, Journal of European Public Policy, 27 (3), 400-418.

Mudge, S.L. and Vauchez A. 2012. Building Europe on a weak field: law, economics, and scholarly avatars in transnational politics, American Journal of Sociology 118(2): pp.449 92.

Mudge, S. L., & Vauchez, A. 2016. Fielding supranationalism: The European Central Bank as a field effect. Sociological Review, 64(suppl.), pp.146 169.

Mudge, S. & Vauchez, A. 2018. Too embedded to fail: The ECB and the necessity of calculating Europe. Historische Sozialforschung , 43 (3), pp.248 273.

Mügge, D. 2015. Studying macroeconomic indicators as powerful ideas. Journal of European Public Policy, 23 (3), 410-427.

Müller, H. 2023. The Case of Europe: A Common Currency Without a Common Public Sphere, in Müller, H., Challenging Economic Journalism. Cham: Springer International Publishing, pp. 179–209.

Polillo, S. 2023. Crisis, reputation, and the politics of expertise: fictional performativity at the Bank of Italy, Review of Social Economy, 81(3), pp. 342–362.

Schmidt-Wellenburg, C. 2017. Europeanisation, stateness, and professions: What role do economic expertise and economic experts play in European political integration?, European Journal of Cultural and Political Sociology, 4(4), pp. 430 456.

Schmidt-Wellenburg, C. and Bernhard, S., 2020. How to chart transnational fields: Introduction to a methodology for a political sociology of knowledge. In Charting Transnational Fields (pp. 1 33). Routledge.

Schneickert, C., 2018. Globalizing political and economic elites in national fields of power. Historical Social Research/Historische Sozialforschung 43 (3 (165), pp.329 358.

Seabrooke, L., 2014. Epistemic arbitrage: Transnational professional knowledge in action. Journal of Professions and Organization 1 (1), pp.49 64.

Seabrooke, L. & Henriksen, L. F. 2017. (Eds.), Professional Networks in Transnational Governance. Cambridge University Press.

Shiller, R.J., 2017. Narrative economics. American Economic Review 107 (4), pp.967 1004.

Stone, D. 2004. Transfer agents and global networks in the “transnationalization” of policy, Journal of European Public Policy, 11(3), pp. 545–566.

Thatcher, Mark & Stone Sweet, Alex 2002. Theory and Practice of Delegation to Non-Majoritarian Institutions, West European Politics, 25 (1), 1-22.

Thiemann, M. 2022. Growth at risk: Boundary walkers, stylised facts and the legitimacy of countercyclical interventions. Economy and Society, 51 (4), pp.630 654.

Tortola, P. D. 2020. The politicisation of the European Central Bank: what is it, and how to study it? Journal of Common Market Studies, 58 (3), 501-513.

Velthuis, O. 2015. Making monetary markets transparent: the European Central Bank’s communication policy and its interactions with the media, Economy and Society, 44(2), pp. 316–340.

Walter, T. 2023. One future to bind them all? Modern central banking and the limits of performative governability, The British Journal of Politics and International Relations.

Wansleben, L., 2018. How expectations became governable: institutional change and the performative power of central banks. Theory and Society 47 (6), pp.773 803.

White, J. 2015. Emergency Europe, Political Studies, 63 (2), 300-318.

Widmaier, W.W., Blyth, M. and Seabrooke, L., 2007. Exogenous shocks or endogenous constructions? The meanings of wars and crises. International studies quarterly 51 (4), pp.747 759.

Beckert, J. 2013. Capitalism as a System of Expectations: Toward a Sociological Microfoundationof Political Economy, Politics & Society, 41(3), pp. 323–350.

Berger, P. & Luckmann, T., 1968. The Social Construction of Reality: A Short Treatise on the Sociology of Knowledge. In F. Dobbin, ed. The New Economic Sociology: A Reader. Princeton, NJ: Princeton University Press, pp.296 317.

Best, J. 2012. Bureaucratic ambiguity, Economy and Society, 41(1), pp. 84–106.

Best, J. 2022. Uncomfortable knowledge in central banking: Economic expertise confronts the visibility dilemma, Economy and Society, pp.1 25.

Blinder, A., Ehrmann, M., Fratzscher, M., De Haan, J. & Jansen, D.-J. 2008. Central Bank Communication and Monetary Policy: A Survey of Theory and Evidence, Journal of Economic Literature , 46 (4), pp.910 945.

Braun, B., 2015. Governing the future: The European Central Bank’s expectation management during the Great Moderation. Economy and Society 44 (3), pp.367 391.

Bressanelli, E., Koop, C. and Reh, C. 2020. EU Actors under Pressure: Politicisation and Depoliticisation as Strategic Responses, Journal of European Public Policy, 27, 329–341.

Callon, M. 2007. What does it mean to say that economics is performative? In D. MacKenzie, F. Muniesa & L. Siu (Eds.), Do economists make markets? On the performativity of economics (pp. 311 357). Princeton University Press.

Coombs, N. 2022. Narrating imagined crises: How central bank storytelling exerts infrastructural power, Economy and Society, pp. 1 24.

Diessner, S. 2022. The power of folk ideas in economic policy and the central bank commercial bank analogy, New Political Economy, pp. 1 14.

De Wilde, P. 2019. Media logic and grand theories of European integration, Journal of European Public Policy, 26(8), pp. 1193 1212.

Do Vale, A., 2021. Central bank independence, a not-so-new idea in the history of economic thought: a doctrine in the 1920s. The European Journal of the History of Economic Thought, 28(5),pp.811-843.

Elgie, R. 2002. The politics of the European Central Bank: principal-agent theory and the democratic deficit, Journal of European Public Policy, 9 (2), 186-200.

Entman, R. M. 1993. Framing: Toward Clarification of a Fractured Paradigm. Journal of Communication, 43(4), pp.51 58.

Eyal, G., 2013. For a sociology of expertise: The social origins of the autism epidemic. american Journal of Sociology, 118(4), pp.863-907.

Eyal, G., 2013. Spaces between fields. Bourdieu and historical analysis, pp.158-182.

Ferrara, F.M. and Angino, S., 2022. Does clarity make central banks more engaging? Lessons from ECB communications. European Journal of Political Economy, 74.

Fourcade, M., 2006. The construction of a global profession: The transnationalization of economics. American Journal of Sociology 112 (1), pp.145 194.

Holmes, D.R., 2013. Economy of words: Communicative imperatives in central banks. University of Chicago Press.

Jasanoff,S. ed., 2004. States of knowledge: the co-production of science and the social order. Routledge.

Kauppi, N. and Madsen, M.R. 2014. Fields of Global Governance: How Transnational Power ElitesCan Make Global Governance Intelligible, International Political Sociology, 8(3), pp. 324–330.

Koop, C. and Scotto di Vettimo, M. 2022. How do the media scrutinise central banking? Evidence from the Bank of England, European Journal of Political Economy, p. 102296.

Lebaron, F. 2008. Central Bankers in the Contemporary Global Field of Power: A Social Space Approach, The Sociological Review, 56(1_suppl), pp. 121–144.

Lohmann, S. 2003. Why do institutions matter? An audience-cost theory of institutional commitment, Governance, 16 (1), 95-110.

Marcussen, M. 2009. Scientization of central banking: The politics of A politicization. In K. Dyson & M. Marcussen (Eds.), Central banks in the age of the euro (pp. 373 401). Oxford University Press.

McCloskey, D.N., 1990. If you're so smart: The narrative of economic expertise. University of Chicago Press.

Medvetz, T., 2012. Murky power:“Think tanks” as boundary organizations. In Rethinking power in organizations, institutions, and markets (Vol. 34, pp. 113-133). Emerald Group Publishing Limited.

Morris, S. and Shin, H.S. 2002. Social Value of Public Information, The American Economic Review,92(5), pp. 1521–1534.

Moschella, M., Pinto, L. & Diodati, N. 2020. Let's speak more? How the ECB responds to public contestation, Journal of European Public Policy, 27 (3), 400-418.

Mudge, S.L. and Vauchez A. 2012. Building Europe on a weak field: law, economics, and scholarly avatars in transnational politics, American Journal of Sociology 118(2): pp.449 92.

Mudge, S. L., & Vauchez, A. 2016. Fielding supranationalism: The European Central Bank as a field effect. Sociological Review, 64(suppl.), pp.146 169.

Mudge, S. & Vauchez, A. 2018. Too embedded to fail: The ECB and the necessity of calculating Europe. Historische Sozialforschung , 43 (3), pp.248 273.

Mügge, D. 2015. Studying macroeconomic indicators as powerful ideas. Journal of European Public Policy, 23 (3), 410-427.

Müller, H. 2023. The Case of Europe: A Common Currency Without a Common Public Sphere, in Müller, H., Challenging Economic Journalism. Cham: Springer International Publishing, pp. 179–209.

Polillo, S. 2023. Crisis, reputation, and the politics of expertise: fictional performativity at the Bank of Italy, Review of Social Economy, 81(3), pp. 342–362.

Schmidt-Wellenburg, C. 2017. Europeanisation, stateness, and professions: What role do economic expertise and economic experts play in European political integration?, European Journal of Cultural and Political Sociology, 4(4), pp. 430 456.

Schmidt-Wellenburg, C. and Bernhard, S., 2020. How to chart transnational fields: Introduction to a methodology for a political sociology of knowledge. In Charting Transnational Fields (pp. 1 33). Routledge.

Schneickert, C., 2018. Globalizing political and economic elites in national fields of power. Historical Social Research/Historische Sozialforschung 43 (3 (165), pp.329 358.

Seabrooke, L., 2014. Epistemic arbitrage: Transnational professional knowledge in action. Journal of Professions and Organization 1 (1), pp.49 64.

Seabrooke, L. & Henriksen, L. F. 2017. (Eds.), Professional Networks in Transnational Governance. Cambridge University Press.

Shiller, R.J., 2017. Narrative economics. American Economic Review 107 (4), pp.967 1004.

Stone, D. 2004. Transfer agents and global networks in the “transnationalization” of policy, Journal of European Public Policy, 11(3), pp. 545–566.

Thatcher, Mark & Stone Sweet, Alex 2002. Theory and Practice of Delegation to Non-Majoritarian Institutions, West European Politics, 25 (1), 1-22.

Thiemann, M. 2022. Growth at risk: Boundary walkers, stylised facts and the legitimacy of countercyclical interventions. Economy and Society, 51 (4), pp.630 654.

Tortola, P. D. 2020. The politicisation of the European Central Bank: what is it, and how to study it? Journal of Common Market Studies, 58 (3), 501-513.

Velthuis, O. 2015. Making monetary markets transparent: the European Central Bank’s communication policy and its interactions with the media, Economy and Society, 44(2), pp. 316–340.

Walter, T. 2023. One future to bind them all? Modern central banking and the limits of performative governability, The British Journal of Politics and International Relations.

Wansleben, L., 2018. How expectations became governable: institutional change and the performative power of central banks. Theory and Society 47 (6), pp.773 803.

White, J. 2015. Emergency Europe, Political Studies, 63 (2), 300-318.

Widmaier, W.W., Blyth, M. and Seabrooke, L., 2007. Exogenous shocks or endogenous constructions? The meanings of wars and crises. International studies quarterly 51 (4), pp.747 759.

Personal Methods-Specific Bibliography (So Far)

Burt, R.S., 2002. The social capital of structural holes. The new economic sociology: Developments in an emerging fi eld, 148(90), p.122.

Granovetter, M.S., 1973. The strength of weak ties. American journal of sociology, 78(6), pp.1360-1380.

Knoke, D. 1993. Networks of Elite Structure and Decision Making. Sociological Methods & Research,22(1), 23–45.

Leifeld, P., 2016. Discourse Network Analysis: Policy Debates as Dynamic Networks. In J. N. Victor, M. N. Lubell, & A. H. Montgomery, eds. Oxford Handbook of Policy Networks. Oxford: Oxford University Press.

Granovetter, M.S., 1973. The strength of weak ties. American journal of sociology, 78(6), pp.1360-1380.

Knoke, D. 1993. Networks of Elite Structure and Decision Making. Sociological Methods & Research,22(1), 23–45.

Leifeld, P., 2016. Discourse Network Analysis: Policy Debates as Dynamic Networks. In J. N. Victor, M. N. Lubell, & A. H. Montgomery, eds. Oxford Handbook of Policy Networks. Oxford: Oxford University Press.

Anna is a Marie Skłodowska Curie Doctoral Fellow at Université Paris 1 Panthéon-Sorbonne and the Université Libre de Bruxelles within the Horizon Europe GEM-Diamond project. Under the joint supervision of Antoine Vauchez (Paris 1) and Amandine Crespy (ULB), her doctoral project mobilises different types of network analysis to examine the phenomenon of central bank watching i.e. the actors involved in and nature of public contestation over monetary policy in the Eurozone.

Anna holds an MA (Hons) in Business/Management and Italian from the University of Glasgow, a Graduate Diploma in International Relations from the University of London, an MA in European Affairs with a specialisation in Economics and Public Policy from Sciences Po Paris and an MSc in Political Economy of Europe from the London School of Economics and Political Science.

Anna holds an MA (Hons) in Business/Management and Italian from the University of Glasgow, a Graduate Diploma in International Relations from the University of London, an MA in European Affairs with a specialisation in Economics and Public Policy from Sciences Po Paris and an MSc in Political Economy of Europe from the London School of Economics and Political Science.

Publications

Zech, A. Forthcoming. ‘No fiscal rule is as strict as it is portrayed in public’. Interview with Philippa Sigl-Glöckner. In Coman, R. and Ponjaert, F. Dissensus over Liberal Democracy: Key Conversations with Leading Voices. Springer.

Zech, A. Forthcoming. Forecasting. In Coman, R., Paternotte, D. and Ponjaert, F. (eds) Impact and Social Sciences: A Conceptual Index.

Zech, A. & O’Dwyer, M. Forthcoming. Quantification. In Coman, R., Paternotte, D. and Ponjaert, F. (eds) Impact and Social Sciences: A Conceptual Index.

Zech, A. 2024. What can we learn from inflation to future-proof our union? in Brière, C., & Foret, F. (eds), 2024. L’IEE a 60 ans!: Penser l’Europe (1964-2024): changements et continuités. Accessible here: https://www.iee-ulb.eu/content/uploads/2024/05/IEE60-BOOK.pdf.

Zech, A. 2024. From Idea(s) to Action: The Why, How and What (Now) of Green Central Banking. CEPS Explainer. Available here: https://www.ceps.eu/ceps-publications/from-ideas-to-action-the-why-how-and-what-now-of-green-central-banking/.

Academic Conferences, Workshops and Webinars

Zech, Anna Sophie. 2025. "To Hike or Not to Hike? The Politics of Eurozone Monetary Policy Expertise During Covid", to be presented at the 2025 BISA Annual Conference, Europa Hotel, Belfast, 20th June 2025.

Zech, Anna Sophie. 2025. "To Hike or Not to Hike? Expert Dissensus over Post-COVID Inflation and the ECB's Policy Response", ECPR Standing Group on Elites and Political Leadership, Webinar, 21st February 2025.

Zech, Anna Sophie. 2024. "Watching The Watchers - On The Expert Networks Translating European Central Bank Communication", presented at the 2024 CES Conference, University Lyon 2 & Sciences Po Lyon, Lyon, 4th July 2024.

Zech, Anna Sophie. 2024. "Central Bank Watcher Conferences: Coordination or Communication?", presented at the 2024 SASE Conference, University of Limerick, Limerick, 27th June 2024.

Zech, Anna Sophie. 2024. “Playing With Fire? Conceptualising the ECB's Interaction With its Watchers”, presented at the Third Doctoral Conference on the Social and Political Constitution of the Economy, Max Planck Institute for the Study of Societies, Cologne, 29 February 2024.

Zech, Anna Sophie. 2023. “Watching the Watchers - On the Expert Networks Translating the European Central Bank's Communication”, presented at the Summer School for Women in Political Economy, Max Planck Institute for the Study of Societies, Cologne, 14 September 2023.

Memberships

PROSPER - Jean Monnet Network, Member

ABSP/Association belge francophone de science politique 2024-2026

BISA/British International Studies Association 2025-2026

SASE/Society for the Advancement of Socio-Economics 2024-2025

CES/Council for European Studies 2024-2025

Training

ECPR Winter School on Social Network Analysis, February 2024

ECPR Summer School on Quantitative Text Analysis, August 2023

BIP Science Communication, March-June 2023

BIP Pluralism of Economic Ideas, November-February 2024/25

Teaching

TD (Travaux Dirigés) Political Science in English, First Year Bachelor in Political Science, Université Paris 1 Panthéon-Sorbonne, Spring Semester 2023

Zech, A. Forthcoming. ‘No fiscal rule is as strict as it is portrayed in public’. Interview with Philippa Sigl-Glöckner. In Coman, R. and Ponjaert, F. Dissensus over Liberal Democracy: Key Conversations with Leading Voices. Springer.

Zech, A. Forthcoming. Forecasting. In Coman, R., Paternotte, D. and Ponjaert, F. (eds) Impact and Social Sciences: A Conceptual Index.

Zech, A. & O’Dwyer, M. Forthcoming. Quantification. In Coman, R., Paternotte, D. and Ponjaert, F. (eds) Impact and Social Sciences: A Conceptual Index.

Zech, A. 2024. What can we learn from inflation to future-proof our union? in Brière, C., & Foret, F. (eds), 2024. L’IEE a 60 ans!: Penser l’Europe (1964-2024): changements et continuités. Accessible here: https://www.iee-ulb.eu/content/uploads/2024/05/IEE60-BOOK.pdf.

Zech, A. 2024. From Idea(s) to Action: The Why, How and What (Now) of Green Central Banking. CEPS Explainer. Available here: https://www.ceps.eu/ceps-publications/from-ideas-to-action-the-why-how-and-what-now-of-green-central-banking/.

Academic Conferences, Workshops and Webinars

Zech, Anna Sophie. 2025. "To Hike or Not to Hike? The Politics of Eurozone Monetary Policy Expertise During Covid", to be presented at the 2025 BISA Annual Conference, Europa Hotel, Belfast, 20th June 2025.

Zech, Anna Sophie. 2025. "To Hike or Not to Hike? Expert Dissensus over Post-COVID Inflation and the ECB's Policy Response", ECPR Standing Group on Elites and Political Leadership, Webinar, 21st February 2025.

Zech, Anna Sophie. 2024. "Watching The Watchers - On The Expert Networks Translating European Central Bank Communication", presented at the 2024 CES Conference, University Lyon 2 & Sciences Po Lyon, Lyon, 4th July 2024.

Zech, Anna Sophie. 2024. "Central Bank Watcher Conferences: Coordination or Communication?", presented at the 2024 SASE Conference, University of Limerick, Limerick, 27th June 2024.

Zech, Anna Sophie. 2024. “Playing With Fire? Conceptualising the ECB's Interaction With its Watchers”, presented at the Third Doctoral Conference on the Social and Political Constitution of the Economy, Max Planck Institute for the Study of Societies, Cologne, 29 February 2024.

Zech, Anna Sophie. 2023. “Watching the Watchers - On the Expert Networks Translating the European Central Bank's Communication”, presented at the Summer School for Women in Political Economy, Max Planck Institute for the Study of Societies, Cologne, 14 September 2023.

Memberships

PROSPER - Jean Monnet Network, Member

ABSP/Association belge francophone de science politique 2024-2026

BISA/British International Studies Association 2025-2026

SASE/Society for the Advancement of Socio-Economics 2024-2025

CES/Council for European Studies 2024-2025

Training

ECPR Winter School on Social Network Analysis, February 2024

ECPR Summer School on Quantitative Text Analysis, August 2023

BIP Science Communication, March-June 2023

BIP Pluralism of Economic Ideas, November-February 2024/25

Teaching

TD (Travaux Dirigés) Political Science in English, First Year Bachelor in Political Science, Université Paris 1 Panthéon-Sorbonne, Spring Semester 2023

-

So What? The Trials and Tribulations of Finding Your Scholarly Identity

23 June 2025

Presenting at conferences can be a good way to work on transforming your niche expertise into a more comprehensive scholarly identity.

-

BIP, BIP, Hooray – An EU Acronym Worth Getting Familiar With

14 August 2024

A concise guide on hybrid, Erasmus-funded academic courses and how they differ from the classic Erasmus semester abroad.

-

What Can We Learn from Inflation to FutureproofOurUnion?

25 March 2024

An op-ed published by Anna Zech for the 60th anniversary of the IEE-ULB

-

From Student to Teacher

30 July 2023

Becoming a scholar is just as much about producing research as it is about sharing it, not least with students.

-

The GEM-DIAMOND’s First Policy AGORA Forum and Citizen Innovation Lab

21 February 2023

A Primer on Policy Work, Local Activism and the Role of Academia in Engaging Dissensus

-

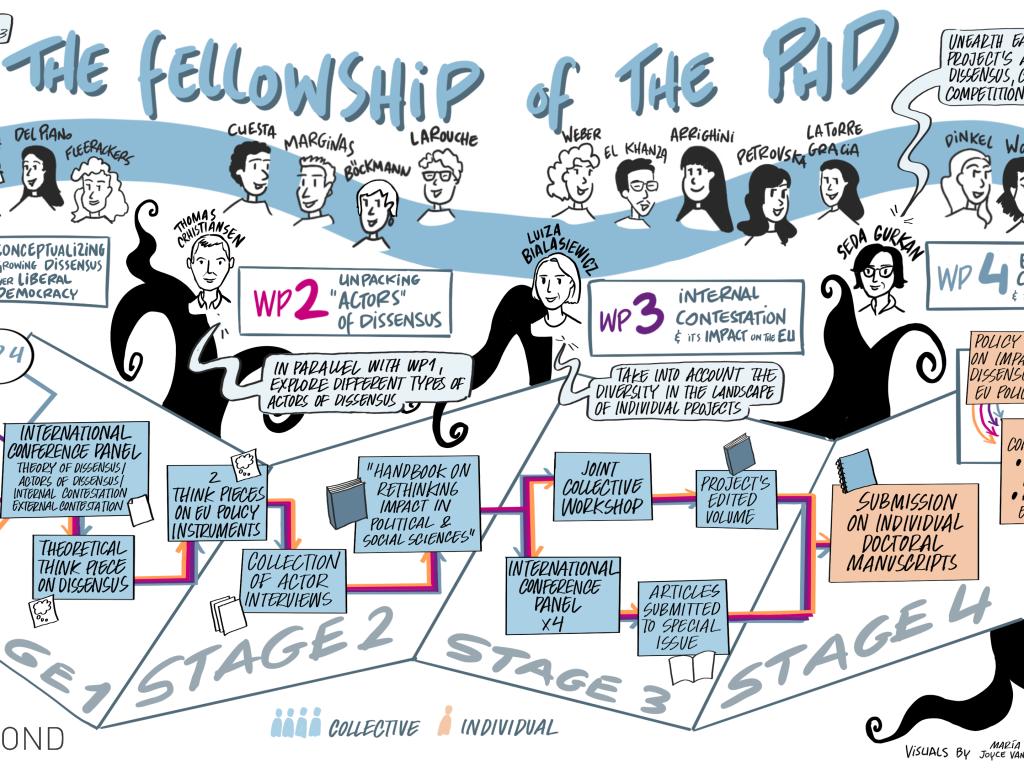

Birth of the GEM-DIAMOND Fellowship of the Ph.D.

1 October 2022

16 MSCA Fellows successfully selected following a gruelling selection process.